Truist Bank routing number is an essential piece of information for anyone who conducts financial transactions with the bank. Whether you're setting up direct deposits, paying bills online, or transferring funds, knowing your routing number is crucial. In this article, we will delve into the details of Truist Bank's routing number, its significance, and how to use it effectively.

Bank routing numbers play a vital role in ensuring that your money moves seamlessly between financial institutions. For Truist Bank customers, having the correct routing number can prevent delays and errors in transactions. This guide will break down everything you need to know about Truist Bank's routing number and its applications in various banking activities.

Our focus will be on providing clear, actionable insights that can help you navigate the complexities of banking with Truist. Let's explore the significance of Truist Bank's routing number and how it impacts your financial transactions.

Read also:Emmitt Smith Iv The Rising Star In The World Of Sports

What is a Truist Bank Routing Number?

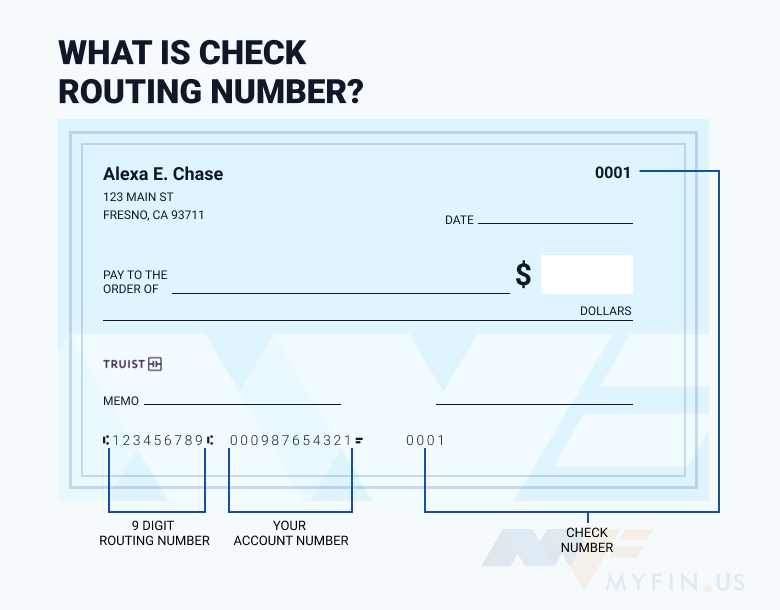

A Truist Bank routing number is a nine-digit code used to identify Truist Bank in financial transactions. This number ensures that funds are routed correctly between banks during processes like direct deposits, wire transfers, and bill payments. Every Truist Bank account is associated with a specific routing number, which varies depending on the state or region where the account was opened.

Routing numbers were originally created by the American Bankers Association (ABA) to streamline the check-clearing process. Today, they serve a much broader purpose, facilitating electronic transactions and ensuring the security of financial operations.

Why is the Truist Bank Routing Number Important?

The importance of a Truist Bank routing number cannot be overstated. Here are a few reasons why it is critical:

- It ensures accurate processing of financial transactions.

- It helps prevent errors in fund transfers, which could lead to delays or losses.

- It enhances the security of your banking operations by verifying the authenticity of the transaction.

Without the correct routing number, transactions can be misdirected, causing frustration and potential financial loss. Therefore, it's essential to use the right routing number for your specific Truist Bank account.

How to Find Your Truist Bank Routing Number

Locating Your Routing Number on Checks

The easiest way to find your Truist Bank routing number is by looking at the bottom of your personal checks. The nine-digit code located at the bottom left corner is your routing number. This method is straightforward and reliable, as it directly corresponds to your account.

Checking Your Online Banking Account

If you don't have checks, you can also find your Truist Bank routing number through your online banking account. Simply log in to your Truist account and navigate to the account information section. Your routing number should be clearly displayed alongside other account details.

Read also:Baruch College Academic Calendar Your Ultimate Guide For The Academic Year

Contacting Truist Bank Customer Service

Another option is to contact Truist Bank's customer service. They can provide you with the correct routing number based on your account details. This method is particularly useful if you're unsure which routing number applies to your account.

Truist Bank Routing Numbers by State

Truist Bank uses different routing numbers depending on the state or region where your account was opened. Below is a list of Truist Bank routing numbers by state:

- Florida: 063102156

- Georgia: 061000089

- North Carolina: 053101469

- South Carolina: 053101469

- Tennessee: 064001460

- Virginia: 051403450

It's crucial to use the routing number that corresponds to your specific state or region to avoid any issues with your transactions.

Using the Truist Bank Routing Number for Different Transactions

Setting Up Direct Deposits

When setting up direct deposits with Truist Bank, you'll need to provide your employer or payer with your routing number and account number. Ensure that you use the correct routing number for your state to avoid delays in receiving your funds.

Initiating Wire Transfers

For wire transfers, you'll need both your routing number and account number. Additionally, for international wire transfers, you may need to provide a SWIFT code. Always double-check the details to ensure a smooth transaction process.

Paying Bills Online

When paying bills online, you'll typically need to enter your routing number and account number. Many bill payment platforms will verify this information to ensure accuracy before processing the payment.

Common Mistakes to Avoid When Using Truist Bank Routing Numbers

Here are some common mistakes people make when using Truist Bank routing numbers:

- Using the wrong routing number for your state or region.

- Entering the routing number incorrectly due to typos or misplacement of digits.

- Confusing the routing number with your account number or other financial codes.

Avoiding these errors can save you time and prevent unnecessary complications in your financial transactions.

Tips for Managing Your Truist Bank Routing Number

Keep Your Information Secure

It's important to keep your routing number and account information secure. Avoid sharing this information unnecessarily and ensure that any platform where you enter these details is legitimate and secure.

Regularly Update Your Records

If you move or change your banking location, be sure to update your records with the correct routing number. This will help ensure that all your transactions are processed without issues.

Stay Informed About Changes

Financial institutions occasionally update their routing numbers. Stay informed about any changes by regularly checking your Truist Bank account or contacting customer service.

Truist Bank Routing Number FAQs

Can I Use the Same Routing Number for Different Accounts?

In most cases, the routing number remains the same for all accounts under the same name within the same state or region. However, always verify this information with Truist Bank to ensure accuracy.

What Happens if I Use the Wrong Routing Number?

Using the wrong routing number can result in delayed transactions or returned payments. Always double-check the routing number before initiating any financial transaction.

Is the Routing Number the Same for Wire Transfers and ACH Transactions?

Truist Bank typically uses the same routing number for both wire transfers and ACH transactions. However, it's always a good idea to confirm this with Truist Bank to avoid any confusion.

Conclusion

Understanding and correctly utilizing your Truist Bank routing number is essential for seamless financial transactions. From setting up direct deposits to initiating wire transfers, having the right routing number ensures that your funds are processed accurately and efficiently. By following the tips and guidelines outlined in this article, you can manage your Truist Bank routing number effectively and avoid common pitfalls.

We encourage you to share this article with others who may benefit from it and to leave your thoughts or questions in the comments section below. Additionally, explore our other articles for more insights into personal finance and banking.

Table of Contents

- What is a Truist Bank Routing Number?

- Why is the Truist Bank Routing Number Important?

- How to Find Your Truist Bank Routing Number

- Truist Bank Routing Numbers by State

- Using the Truist Bank Routing Number for Different Transactions

- Common Mistakes to Avoid When Using Truist Bank Routing Numbers

- Tips for Managing Your Truist Bank Routing Number

- Truist Bank Routing Number FAQs

- Conclusion