In today's digital age, secure access to banking services is more important than ever. BB&T Logon BB&T offers users a safe and convenient way to manage their finances online. With advanced security features and user-friendly interfaces, BB&T ensures that customers can conduct transactions with confidence. Whether you're checking your account balance, transferring funds, or paying bills, BB&T's online platform provides the tools you need to stay in control of your financial life.

Banking online has become an essential part of modern life, allowing people to manage their finances without visiting a physical branch. BB&T Logon BB&T is designed to meet the evolving needs of customers who demand both security and convenience in their banking experience. This article will explore the features, benefits, and best practices for using BB&T's online banking services.

As one of the leading financial institutions in the United States, BB&T has built a reputation for reliability and trust. Their commitment to customer satisfaction is evident in the development of their online banking platform, which combines cutting-edge technology with a user-centric approach. By understanding how to use BB&T Logon BB&T effectively, customers can take full advantage of the services offered by this trusted bank.

Read also:Jimmy Butler Girlfriend Exploring The Relationship And Personal Life Of The Nba Star

Table of Contents

- Introduction to BB&T Logon BB&T

- Benefits of Using BB&T Online Banking

- Key Features of BB&T Logon BB&T

- Understanding BB&T's Security Measures

- Types of Accounts Available

- How to Register for BB&T Online Banking

- Common Issues and Solutions

- Using the BB&T Mobile App

- Best Practices for Secure Banking

- Future Trends in Online Banking

Introduction to BB&T Logon BB&T

What is BB&T Logon BB&T?

BB&T Logon BB&T refers to the online banking service provided by BB&T, one of the largest financial institutions in the United States. This platform allows customers to access their accounts, manage transactions, and perform various banking activities from the comfort of their home or office. BB&T's commitment to digital innovation ensures that users enjoy a seamless and secure experience when interacting with their finances online.

Why Choose BB&T for Online Banking?

With over a century of experience in the financial industry, BB&T has established itself as a trusted partner for individuals and businesses alike. Their online banking platform is designed to meet the diverse needs of customers, offering a range of features that cater to both personal and commercial banking requirements. By choosing BB&T Logon BB&T, users can benefit from a combination of convenience, security, and reliability.

Benefits of Using BB&T Online Banking

BB&T Logon BB&T offers numerous advantages that make it an attractive option for modern banking needs. Some of the key benefits include:

- Accessibility: Customers can access their accounts 24/7 from anywhere in the world, provided they have an internet connection.

- Security: Advanced encryption and multi-factor authentication ensure that users' data remains protected at all times.

- Convenience: The platform allows users to perform a wide range of transactions, such as bill payments, fund transfers, and account monitoring, all in one place.

- Customization: Users can tailor their online banking experience to suit their preferences, with options for setting alerts, creating budgets, and tracking expenses.

Key Features of BB&T Logon BB&T

Account Management Tools

BB&T's online banking platform provides users with comprehensive tools for managing their accounts. These tools include:

- Real-time account balance updates

- Transaction history and categorization

- Customizable alerts for account activity

Bill Payment and Transfer Services

With BB&T Logon BB&T, customers can easily pay their bills and transfer funds between accounts. The platform supports:

Read also:Tulsi Gabbard Pics A Comprehensive Look At Her Journey Achievements And Iconic Moments

- One-time and recurring bill payments

- Domestic and international fund transfers

- Mobile check deposits

Understanding BB&T's Security Measures

Security is a top priority for BB&T, and their online banking platform incorporates multiple layers of protection to safeguard user data. Some of the security measures in place include:

- Encryption: All data transmitted through the platform is encrypted using industry-standard protocols.

- Multi-Factor Authentication: Users are required to provide additional verification, such as a one-time passcode, to access their accounts.

- Fraud Monitoring: BB&T continuously monitors account activity for suspicious behavior and alerts users of potential fraud.

Types of Accounts Available

BB&T offers a variety of account types to meet the diverse needs of its customers. These include:

- Checking Accounts: Designed for everyday transactions, these accounts provide easy access to funds.

- Savings Accounts: Ideal for saving and growing money, these accounts offer competitive interest rates.

- Business Accounts: Tailored for small businesses and entrepreneurs, these accounts include additional features for managing commercial finances.

How to Register for BB&T Online Banking

Step-by-Step Guide

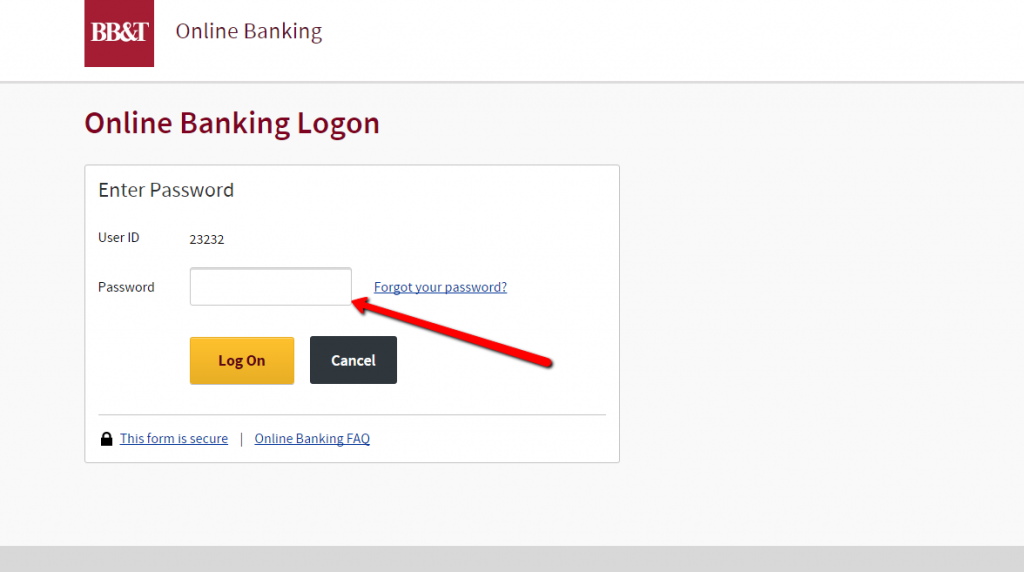

Registering for BB&T Logon BB&T is a straightforward process. Follow these steps to get started:

- Visit the BB&T website and navigate to the online banking registration page.

- Enter your account information, including your account number and Social Security number.

- Create a username and password for your online banking account.

- Set up security questions and answers for added protection.

- Confirm your registration by verifying your email address or phone number.

Common Issues and Solutions

While BB&T Logon BB&T is designed to provide a smooth user experience, occasional issues may arise. Some common problems and their solutions include:

- Forgot Password: Use the "Forgot Password" feature to reset your login credentials.

- Account Lockout: Contact BB&T customer support to unlock your account if it becomes locked due to multiple failed login attempts.

- Technical Issues: Check the BB&T website for any announcements regarding platform maintenance or downtime.

Using the BB&T Mobile App

For added convenience, BB&T offers a mobile app that allows users to access their accounts on the go. The app includes all the features available on the desktop platform, with additional functionality such as mobile check deposits and location-based services. To download the app, visit the Apple App Store or Google Play Store and search for "BB&T Mobile Banking."

Best Practices for Secure Banking

To ensure a safe and secure online banking experience, follow these best practices:

- Use strong, unique passwords for your BB&T account and enable multi-factor authentication.

- Avoid accessing your account on public Wi-Fi networks or shared devices.

- Regularly monitor your account activity and report any suspicious transactions to BB&T immediately.

Future Trends in Online Banking

The world of online banking is constantly evolving, with new technologies emerging to enhance the user experience. Some of the trends to watch for in the near future include:

- Artificial Intelligence: AI-powered chatbots and virtual assistants will provide customers with personalized support and insights.

- Biometric Authentication: Fingerprint and facial recognition technology will become more prevalent for secure account access.

- Blockchain Technology: This innovative technology may be used to improve the speed and security of financial transactions.

Conclusion

BB&T Logon BB&T provides customers with a secure, convenient, and feature-rich platform for managing their finances online. By leveraging advanced technology and adhering to strict security standards, BB&T ensures that users can conduct their banking activities with confidence. Whether you're a long-time customer or new to the bank, BB&T's online banking services offer the tools and resources you need to stay in control of your financial life.

We encourage you to take advantage of the features and benefits offered by BB&T Logon BB&T. For more information, visit the BB&T website or contact their customer support team. Don't forget to share this article with your friends and family, and explore other resources on our site to enhance your financial knowledge. Together, let's build a brighter financial future.

Data Sources:

- BB&T Official Website

- FDIC Consumer News

- Federal Reserve Publications