In today's fast-paced world, managing your bills has never been easier with the rise of digital payment platforms. Metro Pay Bill Online is one such solution that allows users to pay their bills seamlessly from the comfort of their homes. Whether you're handling utility bills, credit card payments, or subscriptions, this platform offers convenience, security, and efficiency. In this article, we will delve into the features, benefits, and tips for using Metro Pay Bill Online effectively.

Metro Pay Bill Online has revolutionized the way people manage their finances. By eliminating the need for physical visits to payment centers, this platform ensures that users can handle their financial obligations anytime and anywhere. As more individuals embrace digital solutions, understanding how Metro Pay Bill Online works becomes crucial for optimizing your financial management.

This article will explore the ins and outs of Metro Pay Bill Online, including its features, security measures, and tips for maximizing its benefits. Whether you're a first-time user or looking to enhance your experience, this guide will provide you with all the information you need to make informed decisions about your bill payments.

Read also:Cheryl Hines A Rising Star In The Entertainment Industry

Table of Contents

- Introduction to Metro Pay Bill Online

- Key Features of Metro Pay Bill Online

- Benefits of Using Metro Pay Bill Online

- Security Measures in Metro Pay Bill Online

- How to Set Up Metro Pay Bill Online

- Payment Methods Available on Metro Pay Bill Online

- Tips for Maximizing Your Experience

- Common Issues and Troubleshooting

- Statistics and Growth of Online Bill Payments

- The Future of Metro Pay Bill Online

Introduction to Metro Pay Bill Online

Metro Pay Bill Online is a digital payment platform designed to simplify the process of paying bills. It offers users the ability to manage their financial obligations without the hassle of visiting physical payment centers. This platform supports various types of bills, including utilities, subscriptions, and credit card payments, making it a versatile tool for modern consumers.

With the increasing demand for digital solutions, Metro Pay Bill Online has become a go-to choice for individuals seeking convenience and reliability in their bill payment processes. By leveraging advanced technology and user-friendly interfaces, this platform ensures that users can complete transactions quickly and securely.

Key Features of Metro Pay Bill Online

1. User-Friendly Interface

Metro Pay Bill Online boasts an intuitive and easy-to-navigate interface, ensuring that even first-time users can complete transactions with ease. The platform's design prioritizes simplicity and accessibility, making it suitable for users of all technical skill levels.

2. Multiple Payment Options

Users can choose from a variety of payment methods, including credit cards, debit cards, and bank transfers. This flexibility ensures that everyone can find a payment option that suits their preferences and financial situation.

3. Automated Billing

One of the standout features of Metro Pay Bill Online is its automated billing system. Users can set up recurring payments for regular bills, eliminating the need for manual intervention and reducing the risk of missed payments.

Benefits of Using Metro Pay Bill Online

Using Metro Pay Bill Online offers numerous advantages, including:

Read also:Tulsi Gabbard Pics A Comprehensive Look At Her Journey Achievements And Iconic Moments

- Convenience: Pay your bills anytime and anywhere using your smartphone, tablet, or computer.

- Time-Saving: Eliminate the need for physical visits to payment centers, saving you valuable time and effort.

- Security: Enjoy peace of mind with advanced security measures that protect your financial information.

- Efficiency: Streamline your bill payment process with automated billing and real-time transaction updates.

Security Measures in Metro Pay Bill Online

Metro Pay Bill Online prioritizes the security of its users' financial information. The platform employs industry-standard encryption protocols to protect sensitive data during transactions. Additionally, it offers two-factor authentication (2FA) to ensure that only authorized users can access their accounts.

Data breaches and cyber threats are serious concerns in the digital age, but Metro Pay Bill Online takes proactive measures to safeguard its users' information. Regular security audits and updates ensure that the platform remains resilient against potential threats.

How to Set Up Metro Pay Bill Online

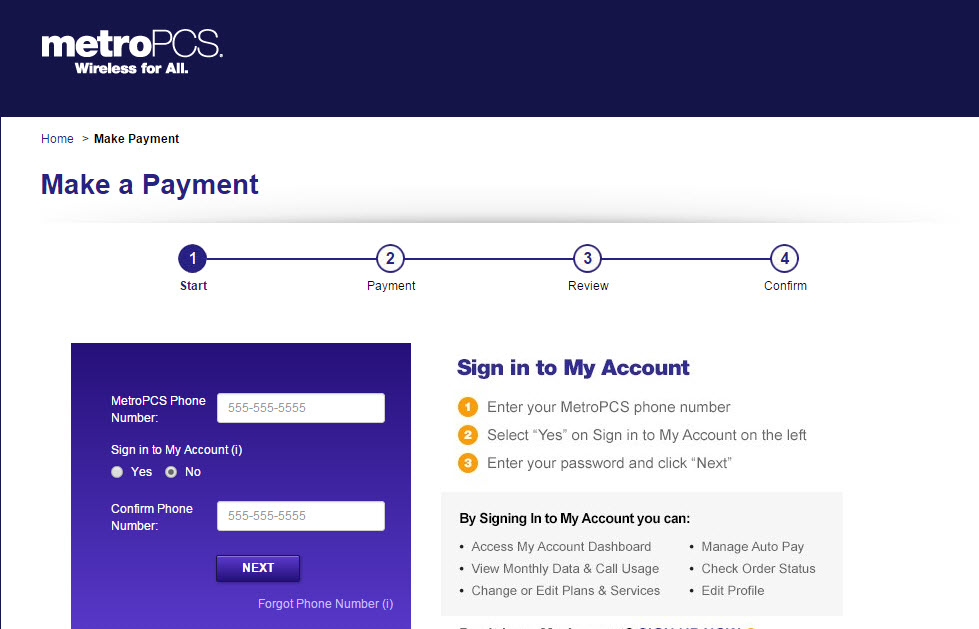

Step 1: Create an Account

To get started with Metro Pay Bill Online, you'll need to create an account. Visit the official website and follow the registration process, providing the necessary information such as your name, email address, and contact details.

Step 2: Verify Your Identity

Once your account is created, you'll need to verify your identity. This step ensures the security of your account and compliance with regulatory requirements. You may be asked to upload identification documents or provide additional information.

Step 3: Link Your Payment Methods

After verifying your identity, link your preferred payment methods to your account. This can include credit cards, debit cards, or bank accounts. Ensure that all information is accurate to avoid payment issues.

Payment Methods Available on Metro Pay Bill Online

Metro Pay Bill Online supports a wide range of payment methods, including:

- Credit Cards

- Debit Cards

- Bank Transfers

- Mobile Wallets

This diversity ensures that users can choose the payment method that best suits their needs and preferences.

Tips for Maximizing Your Experience

1. Set Up Alerts

Enable payment reminders and alerts to stay on top of your bill due dates. This feature helps prevent late payments and associated fees.

2. Review Statements Regularly

Regularly review your transaction history and billing statements to ensure accuracy and detect any discrepancies early.

3. Explore Discounts and Promotions

Keep an eye out for discounts and promotions offered by Metro Pay Bill Online. These can help you save money while managing your bills.

Common Issues and Troubleshooting

While Metro Pay Bill Online is designed to be user-friendly, users may occasionally encounter issues. Common problems include:

- Payment Failures: Ensure that your payment method has sufficient funds and is correctly linked to your account.

- Account Access Issues: Reset your password or contact customer support if you're unable to log in to your account.

- Technical Errors: Clear your browser cache or try accessing the platform from a different device if you encounter technical issues.

Statistics and Growth of Online Bill Payments

The adoption of online bill payment platforms has grown significantly in recent years. According to a report by Statista, the global digital payment market is expected to reach $6.7 trillion by 2023. This growth is driven by increasing internet penetration, improving digital infrastructure, and changing consumer preferences.

Metro Pay Bill Online is part of this growing trend, offering users a reliable and convenient solution for managing their financial obligations. As more individuals embrace digital payment methods, platforms like Metro Pay Bill Online will continue to play a crucial role in shaping the future of financial management.

The Future of Metro Pay Bill Online

Looking ahead, Metro Pay Bill Online is poised to expand its offerings and enhance its capabilities. Future developments may include:

- Integration with smart home devices for seamless bill management.

- Advanced analytics tools to help users track and optimize their spending.

- Expanded support for international payment methods to cater to a global audience.

As technology continues to evolve, Metro Pay Bill Online will remain at the forefront of innovation, ensuring that users can manage their finances with ease and confidence.

Conclusion

Metro Pay Bill Online offers a comprehensive solution for managing your bills in the digital age. With its user-friendly interface, diverse payment options, and robust security measures, this platform provides users with the tools they need to handle their financial obligations efficiently and securely. By following the tips outlined in this guide, you can maximize your experience and take full advantage of the platform's features.

We encourage you to share your thoughts and experiences with Metro Pay Bill Online in the comments section below. Additionally, feel free to explore our other articles for more insights into digital finance and payment solutions. Together, let's embrace the future of financial management and make bill payments effortless and stress-free.

References:

- Statista. (2023). Global digital payment market forecast. Retrieved from [statista.com]

- Forrester. (2022). The rise of digital payments. Retrieved from [forrester.com]