Los Angeles County tax is a critical aspect of financial planning for both individuals and businesses. Whether you're a homeowner, an entrepreneur, or a taxpayer, understanding the intricacies of the local tax system can help you make informed decisions. This article aims to provide a detailed overview of the tax structure in Los Angeles County, covering everything from property taxes to sales taxes.

Taxes play a pivotal role in the functioning of any community, and Los Angeles County is no exception. The funds generated from these taxes are used to support essential services such as public safety, education, healthcare, and infrastructure. By staying informed about the tax obligations in the county, residents can ensure they are compliant with local regulations.

This guide will explore various aspects of Los Angeles County tax, including rates, deadlines, exemptions, and payment methods. Whether you're a new resident or a seasoned taxpayer, this article will provide valuable insights to help you navigate the tax landscape effectively.

Read also:Dean S Jagger A Comprehensive Look At His Career Biography And Impact

Table of Contents

- Overview of Los Angeles County Tax

- Property Tax in Los Angeles County

- Sales Tax in Los Angeles County

- Income Tax in Los Angeles County

- Business Taxes in Los Angeles County

- Tax Exemptions and Credits

- Important Tax Deadlines

- Payment Methods and Procedures

- Tax Appeals Process

- Useful Resources and References

Overview of Los Angeles County Tax

Los Angeles County tax encompasses a variety of levies that apply to residents, businesses, and visitors. These taxes are designed to fund public services and infrastructure, ensuring the county remains a vibrant and safe place to live and work. The primary types of taxes include property tax, sales tax, and income tax, each with its own set of rules and regulations.

According to the Los Angeles County Assessor's Office, the tax system is structured to be fair and transparent, with clear guidelines on how taxes are calculated and collected. Understanding these guidelines is essential for all taxpayers to avoid penalties and ensure compliance.

Key Takeaways:

- Taxes fund essential services in Los Angeles County.

- The tax system includes property, sales, and income taxes.

- Guidelines ensure fairness and transparency in tax collection.

Property Tax in Los Angeles County

Understanding Property Tax Rates

Property tax in Los Angeles County is assessed based on the assessed value of the property. The rate is typically 1% of the assessed value, as mandated by Proposition 13, which was passed in 1978. However, additional assessments may apply, such as school bonds and special district fees, which can increase the overall tax burden.

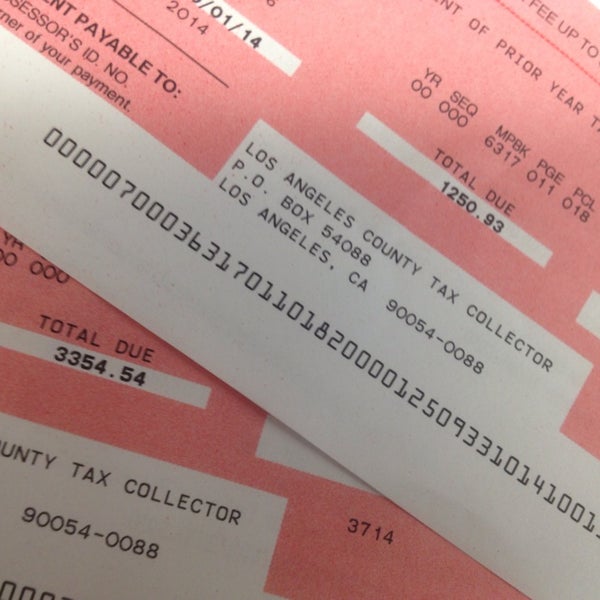

Data from the Los Angeles County Tax Collector shows that property tax bills are sent out twice a year, with payments due in November and February. Failure to pay on time can result in penalties and interest charges.

Exemptions and Deductions

Homeowners in Los Angeles County may qualify for various exemptions and deductions, such as the Homeowners' Exemption, which reduces the assessed value of a primary residence by $7,000. Additionally, senior citizens and disabled individuals may be eligible for further reductions in property taxes.

Read also:Eric Greenspan The Culinary Innovator Revolutionizing The Food Industry

Important Note: Taxpayers must apply for these exemptions to receive the benefits.

Sales Tax in Los Angeles County

Sales tax in Los Angeles County varies depending on the city or unincorporated area where the transaction occurs. The base rate is 7.25%, but local jurisdictions may add additional taxes, resulting in rates as high as 10.1%. This tax applies to most goods and services purchased within the county.

According to the California Department of Tax and Fee Administration (CDTFA), businesses are responsible for collecting and remitting sales tax to the appropriate authorities. Failure to comply can result in fines and legal action.

Income Tax in Los Angeles County

While Los Angeles County does not impose a local income tax, residents are subject to state and federal income taxes. The California Franchise Tax Board (FTB) oversees the collection of state income taxes, which are progressive and based on income levels.

Tax Tip: It's essential to consult a tax professional or use tax preparation software to ensure accurate reporting and minimize liability.

Business Taxes in Los Angeles County

Business License Tax

Businesses operating in Los Angeles County are required to obtain a business license and pay an associated tax. The amount of the tax depends on the type of business and its annual gross receipts. The Los Angeles County Business Tax Registration Division provides detailed information on these requirements.

Payroll Taxes

Employers in Los Angeles County must also comply with payroll tax regulations, which include withholding federal and state income taxes, Social Security, and Medicare contributions from employee wages. Failure to comply can result in significant penalties.

Tax Exemptions and Credits

Los Angeles County offers various tax exemptions and credits to eligible taxpayers. These include:

- Homeowners' Exemption

- Senior Citizen Exemption

- Disabled Persons Exemption

- Property Tax Deferral Program for Seniors

Taxpayers should consult the Los Angeles County Assessor's Office for more information on these programs.

Important Tax Deadlines

Staying on top of tax deadlines is crucial to avoid penalties and interest charges. Key deadlines for Los Angeles County taxpayers include:

- Property Tax: November 1 and February 1

- Business License Tax: April 30

- State Income Tax: April 15

Mark these dates on your calendar to ensure timely compliance.

Payment Methods and Procedures

Online Payment Options

Taxpayers in Los Angeles County can pay their taxes online through the Los Angeles County Tax Collector's website. This convenient option allows for secure payments using credit or debit cards.

In-Person Payment

For those who prefer in-person transactions, payment can be made at designated drop-off locations throughout the county. Cash, checks, and money orders are accepted.

Tax Appeals Process

If a taxpayer disagrees with their assessed property value or tax bill, they have the right to file an appeal. The Los Angeles County Assessment Appeals Board handles these cases, providing a fair and impartial review process.

Steps to File an Appeal:

- Submit a formal appeal application.

- Provide supporting documentation.

- Attend a hearing if necessary.

Useful Resources and References

For more information on Los Angeles County tax, consider consulting the following resources:

- Los Angeles County Official Website

- California Franchise Tax Board

- California Department of Tax and Fee Administration

Conclusion

Understanding Los Angeles County tax is essential for all residents and businesses. By staying informed about the various types of taxes, exemptions, and deadlines, taxpayers can ensure compliance and avoid unnecessary penalties. This guide has provided a comprehensive overview of the tax landscape in Los Angeles County, equipping readers with the knowledge they need to navigate the system effectively.

We encourage you to share this article with others who may benefit from the information. For further insights, explore our other articles on financial planning and tax strategies. Together, we can build a more informed and financially savvy community.